Why is my Homeowners Insurance so high in North Carolina

The average cost of homeowners insurance in NC is now $2,459 per year, which is now more expensive than the national average of $2,304 per year. If you want to know why insurance costs continue to increase, please read the explanation for the premium increases across the state (and across the country) below.

There is an insurance crisis in the US and it most definitely affecting NC. (See https://www.policygenius.com/homeowners-insurance/news/is-the-insurance-crisis-spreading-to-north-carolina/Insurance) Insurance companies are trying to stay profitable so they don’t declare bankruptcy.

- Claims – HOME

North Carolina is the THIRD most hurricane prone state in the US1. In 2023 NC ranked 7th in the country for the average homeowners lightning claim at $12,3372

Even if you didn’t have a claim, every other person’s claim affects your insurance. One in every TEN NC homes had a claim last year.1

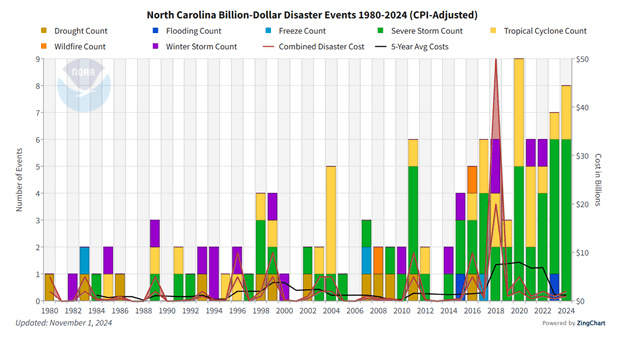

From 1980 to 2024 NC has experienced 120 weather and climate disasters that caused over $1 billion in losses EACH.3 Per the chart below, the storms have increased steadily every year… but have increased the most in the past 10 years.

In 2024, NC was hit by 19 Tropical Storms and/or Hurricanes. Five were Category 3 storms, two were Category 5 storms and FOUR were Category 4 storms. In just the past 5 years from 2020 to 2024 there have been 20 storms that were CAT 3 or greater (5 CAT 3 storms, 11 CAT 4 storms and 4 CAT 5 storms).5

Since 2020 NC has been hit with 110 storms! 2023 NC had 22 storms, 2022 had 17, 2021 had 21 storms and 2020 had 31 storms.

In the nine years between 2010-2019 there were 166 storms. Of the 166, 30 of them were CAT 3 or greater.5

The storms are not only increasing in strength, but they are more of them.5

When you compare the statistics, the trend is alarming.

From 2017-2024 there were 23 Category 4 and 5 storms – and we still have 3 more years in this decade.

From 2006-2016 there were 17 Category 4 and 5 storms

From 1995-2005 there were 28 Category 4 and 5 storms

From 1984-1994 there were 9 Category 4 and 5 storms

From 1973-1983 there were 10 Category 4 and 5 storms

From 1962-1972 there were 10 Category 4 and 5 storms

From 1951-1961 there were 18 Category 4 and 5 storms

From 1940-1950 there were 12 Category 4 and 5 storms

From 1929-1939 there were 17 Category 4 and 5 storms

From 1918-1928 there were 8 Category 4 and 5 storms

Every state in the Union has seen an increase in their weather related claims. Even though some disasters happen in other states, it affects our premiums. Insurance companies write in multiple states. What happens in one state affects other states. 2017 USA had THREE hurricanes that caused over $1 billion dollars in total damages. Hurricane Ida in 2021 caused $39 million and in 2022 Hurricane Ian caused $52 million dollars in damages.2

Claims – CYBER

The newest (and scariest) of claims?… cyber! Nationwide fraud losses topped $10 billion in 2023.14

Claims – AUTO

Accidents are more expensive due to the increase in auto part prices, supply chain disruption, higher vehicle cost/value and labor costs.

Auto insurance companies paid out $196.8 billion in 20212. This was a record amount of auto insurance claims ever paid out. Total payout in 2022 was $105 billion2.

Since 2019, bodily injury and property damage severity have increased by 40%11 The average cost of a bodily injury claim was $26,501.13

In 2022 AND 2023, 27% of collision claims were total losses.11 The average automobile property damage claim in 2022 was $5,992, which was a 15-year high.6 Auto theft accounts for $7.4 BILLION in insurance losses annually.17

- Increasing cost of building material

Since 2020 the average cost of building material costs have increased by 37.7%4. In the past, insurance companies have increased the dwelling coverage by 2%-4% to meet the increasing cost of building materials. Now, to keep your home insured at 100%, companies are having to increase the dwelling limits by 20-40%. Some NC counties have seen an increase in building material cost of 50%-70%.

Note: If you believe that your home dwelling limit is insufficient to meet the 100% replacement cost requirement, please let me know and I will work on a new replacement cost estimator with you.

- More lawsuits and fraud

Insurance companies are being drawn into lawsuits in which the client was not negligent. Lawyers are suing anyone and everyone looking for the “deep pockets” to pay for claims, even when the insurance client did nothing wrong.

Insurance fraud results in higher premiums for consumers, as well as higher taxes and inflation on consumer goods.16 An estimated 20% of insurance claims are fraudulent.14 Forbes Advisor estimates the cost to CONSUMERS to be $308.6 billion annually.13 Property and casualty fraud has increased in from $38 billion in 2016 to $45 billion in 2020.17 In 2020 8,898 cars were intentionally set on fire in the US.17

Workers Compensation fraud accounts for $34 billion in insurance losses annually.17

- Less companies

More and more insurance companies are either closing their doors, being bought by other companies, limiting where/what they will write or not writing any new business at all.

Insurance companies are not making money. State Farm reported a net loss of 6.3 billion dollars in 20237,a net loss of $6.7 billion in 20227 and a net loss of $1.3 billion in 2021.6 If this continues, State Farm may be the next company to stop writing insurance in some or all states.

Bankruptcy – United Property & Casualty was declared insolvent February 2023. When Lighthouse declared bankruptcy in April 2022, they caused a LOT of problems, including financial. The State of NC Department of Insurance (DOI) assessed all the OTHER insurance companies that write in NC a “fee” that totaled $12 million dollars to make sure that clients that had Lighthouse and have claims can get those claims paid.

I understand the reasoning. I never want to see a person lose their house when they had a policy and a valid claim. Unfortunately, when the DOI told insurance companies that they had to pay for the claims that were not THEIR clients, a LOT of insurance companies decided to stop writing either home and auto completely in NC.

No longer writing – Heritage and Universal Property Casualty Insurance Company are only writing in certain counties. Nationwide is no longer writing insurance in NC as of July 2023, Allstate stopped writing any personal insurance in October 2023.

Sold – Safeco and State Auto were bought by Liberty Mutual. We were notified that as of 2023, both Safeco and State Auto will be using the Liberty Mutual home rates (which are an average of 110% higher than Safeco and State Auto rates).

Metlife was not profitable, so they sold their personal lines division to Farmers. Again, Farmers is saying that the MetLife rates were too low and their guidelines too lenient, and there will be increases in the rates (an average of 40%) and more strict guidelines.

Downgraded – Other insurance companies have had so many claims that their financial stability has been “downgraded”. Once an insurance company has an AM Best rating lower than B+, insurance agents cannot write with them or risk losing their contracts. Discovery Insurance Co was downgraded to bb (from stable to negative) per AM Best7. State Farm was downgraded from an A to a B.7 NC Farm Bureau was downgraded from an A to an A-. 7

NC is still doing better than many states. Florida and California have seen a mass exodus of insurance companies. Since 2003, 41 Florida insurers have declared bankruptcy. As of May 2023, 11 companies are in liquidation.9 According to virtual insurance company Insurify, Florida homeowners paid an average annual premium of $10,996 in 2023.

California lost Allstate, Farmers, State Farm, Geico, AmGuard, Liberty Mutual, Safeco, Hartford and Kemper (among many, many others). In 2000 California had 1,500 insurance companies.11 CA only has 100 companies writing insurance in that state now.10

Categories: Blog